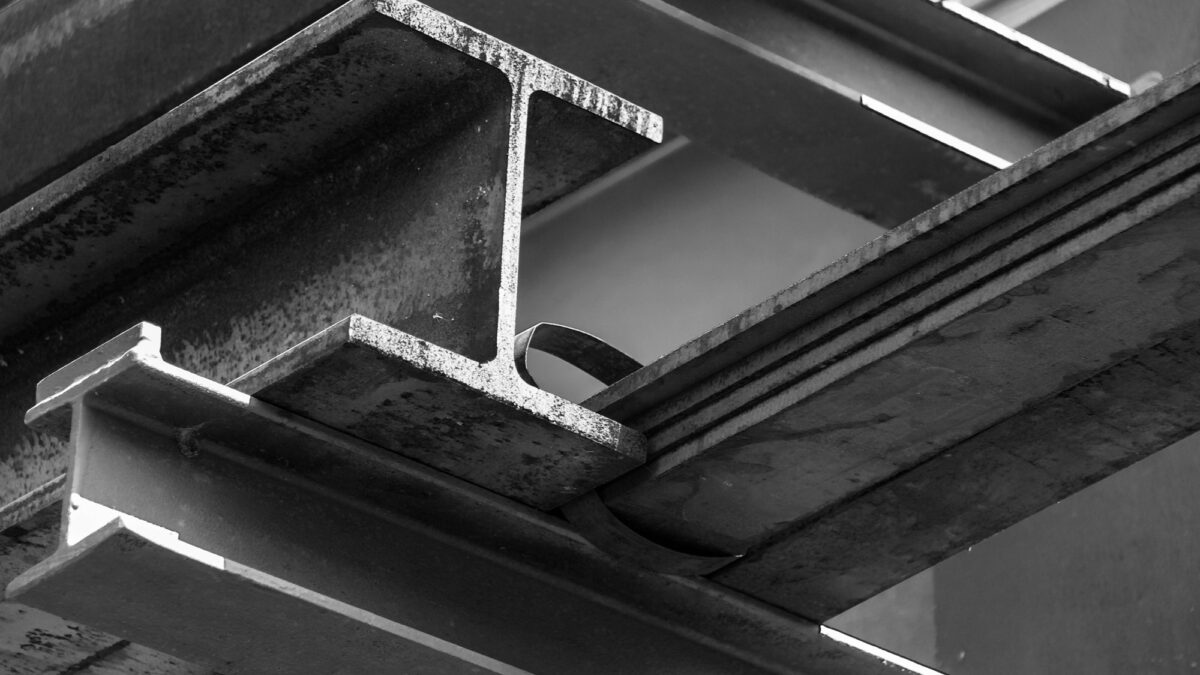

If you are involved in manufacturing, we don’t have to remind you that the COVID-19 pandemic caused increases in nearly all raw commodities, as well as significant strains on the supply chain. In particular, the price of steel dramatically increased the cost of finishing systems. Steel prices are up 219% since early 2020 according to the August article linked above. This obviously affects the cost of steel used in washers, ovens, booths, shotblasts, and conveyors.

Let’s take a look into the raw steel market and what that means for finishing systems.

The Cost of Steel

Steel prices are a function of many market factors including supply, demand, and the cost of underlying raw materials. According to the 2021 Steel Price Forecast by General Steel Buildings, coal prices have also surged almost 200% since the beginning of this year. Meanwhile, demand is up and supply is having a hard time keeping up because many suppliers turned off their blast furnaces during the 2020 shut down.

The cost of steel is also influenced by economics both domestically and globally. Domestically these include the strength of the U.S. dollar, demand for steel in any product, and trade tariffs. Globally, these include the world’s economy, natural disasters, wars, and other political events.

The pandemic created a unique situation for the steel industry. Lockdowns, unemployment, and the uncertainty of COVID-19 saw the demand for steel to drastically drop. In February of 2021, it bottomed out before making a comeback in May.

When the lockdowns were lifted, demand picked up, but it wasn’t enough to fully help the steel industry fully recover. 2020 steel demand dropped 15.3 percent from 2019, but prices have steadily increased since December of 2020.

When the lockdowns were lifted, demand picked up, but it wasn’t enough to fully help the steel industry fully recover. 2020 steel demand dropped 15.3 percent from 2019, but prices have steadily increased since December of 2020.

While there have been reports of spot shortages of steel for some types of steel, for the most part, the steel is available – just much more costly. U.S. Steel imports were up 17.4 percent as recently as Aug. 25, 2021.

So steel is affecting the costs of finishing systems, but another factor is also affecting systems that is not directly tied to the steel industry. That factor is the general disruption of the supply chain.

These include rather everyday system parts of any type. In fact, it’s somewhat difficult to predict what formally abundant supply chain parts might suddenly become scarce. Fanless PC’s for example, may be the new toilet paper! The scramble for us and other finishing system providers to find workarounds is constant and can add incrementally to the cost and timeline of any installation.

What This Means For The Cost of Finishing Systems

The most challenging aspect of the rapid rise in steel prices and the uncertainty of the supply chain for IntelliFinishing is that it’s much more difficult for us to do budgetary estimates and predict a timeline for installation. Traditionally, we base our budgetary quotes on our historical information on previous bids we’ve quoted, as well as those we’ve sold. We do it this way because it’s fast. We can usually do a draft layout of a  system and offer a budgetary quote in just a few days, sometimes quicker.

system and offer a budgetary quote in just a few days, sometimes quicker.

Now, all of a sudden, our historical price data is way off. We’ve even had a few prospects who obtained budgetary quotes before the most recent run-up in steel prices, who were shocked at the prices for their formal quotes done just months later.

The alternative to using historical data for budgetary quoting is to actually get updated quotes from all system vendors based on their current costs for the materials required. This option, however, is often not very quick. All systems involve multiple vendors and some vendor quotes are contingent on other vendor quotes. Seeking pricing in this manner may add several weeks to a budgetary quote. Of course, this process is routine for formal quotes, because those quotes need to be very exact as customers will hopefully purchase the systems quoted. They aren’t just seeking an internal request for capital spending…they are wanting to buy the proposed system at a firm price.

One more troubling aspect of rapidly rising steel prices is that it gets much harder to hold on to the quoted price for any length of time. Vendors supplying steel equipment include strong language that the quote is only suitable for a relatively short period. Most quotes contained these timing clauses in the past, but since prices were stable, even if a quote decision came in after the proposal stated timeframe, the quoted price was generally honored. Now, it’s much more common for quotes to be requoted if a decision cannot be made in the stated proposal timeframe.

Will This Affect The Timeliness of IntelliFinishing Systems?

All this said, the rise in steel prices, the scarcity of steel, and the holes in supply chain for formally abundant parts, have not caused any delays in installations of IntelliFinishing systems so far.

More directly, simple demand for aspects of systems, including for quotes and installed systems has pushed out normal delivery timeframes somewhat. Everyone in the industry seems to be inordinately busy so far this year based on conversations we had with co-vendors and competitors at FabTech and other industry events. So, if you are considering a new finishing system and you suspect an IntelliFinishing system would be a good fit for you, we encourage you to seek us out as soon as possible to start that discussion. While you are at it, if you need to build new, or modify your existing facility, you should start looking for a general contractor as early as possible, too. We understand most of them are buried in work too!

Related posts

Search this blog

Get email updates

Archives

- May 2024

- April 2024

- August 2023

- May 2023

- April 2023

- March 2023

- June 2022

- May 2022

- April 2022

- November 2021

- October 2021

- September 2021

- April 2021

- March 2021

- January 2021

- October 2020

- August 2020

- June 2020

- May 2020

- February 2020

- January 2020

- December 2019

- October 2019

- September 2019

- June 2019

- May 2019

- March 2019

- February 2019

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- December 2016

- June 2016

- May 2016

- April 2016

- February 2016

- January 2016

- September 2015

- June 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- August 2014

- June 2014

- May 2014

- April 2014

- August 2013

- July 2013

- March 2013

- October 2012

- September 2012

- March 2011

- February 2011

- January 2011

- October 2010